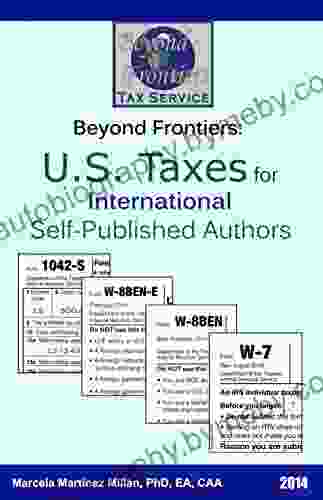

Taxes For International Self Published Authors: A Comprehensive Guide to Maximizing Your Earnings

5 out of 5

| Language | : | English |

| File size | : | 3158 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 64 pages |

As a self-published author venturing into the global literary landscape, navigating the complexities of international tax laws can be a daunting task. This comprehensive guide aims to empower you with the knowledge and strategies to optimize your tax obligations, maximize your earnings, and stay compliant with varying tax jurisdictions worldwide.

Understanding Tax Obligations

When it comes to taxes, every country has its own unique set of rules and regulations. To avoid costly mistakes and penalties, it's crucial to understand the tax obligations specific to your country of residence and the regions where you distribute your books.

Residence-Based Taxation

Most countries adopt a residence-based taxation system, which means you are taxed on your worldwide income regardless of where it is earned. As a resident author, you will typically be liable for income tax on your writing earnings.

Source-Based Taxation

Some countries may also impose source-based taxation, where income earned within their bFree Downloads is subject to tax regardless of your residency status. This can be particularly relevant if you sell books through online retailers that have a local presence in multiple jurisdictions.

Tax Optimization Strategies

Understanding your tax obligations is the first step. Next, let's explore strategies to optimize your tax situation and increase your take-home pay.

Entity Selection

Choosing the right business entity for your author business can have significant tax implications. Sole proprietorships, limited liability companies (LLCs),and S corporations offer varying levels of tax liability and benefits.

Deductions and Expenses

Identify eligible expenses related to your writing business that can be deducted from your taxable income. These may include marketing costs, research expenses, and travel expenses for book events.

Royalty Structures

The structure of your royalties can impact your tax liability. Consider setting up royalty agreements that are structured as business income rather than personal income, which may result in more favorable tax treatment.

Foreign Tax Credits

If you pay taxes on your writing income in one country and distribute your books in another, you may be eligible for foreign tax credits to avoid double taxation.

Global Tax Considerations

When it comes to international self-publishing, understanding the tax landscape beyond your home country is essential.

Tax Treaties and Double Taxation Agreements

To prevent double taxation, many countries have entered into tax treaties or double taxation agreements. These agreements determine which country has the primary taxing rights over your writing income.

Value Added Tax (VAT)

VAT is a consumption tax levied on the sale of goods and services within the European Union and other countries. As an author, you may be responsible for registering for and collecting VAT if you sell books within these jurisdictions.

Withholding Taxes

When you sell books through online retailers that operate in multiple countries, you may encounter withholding taxes, where a percentage of your royalties is withheld and paid to the government.

Seek Professional Guidance

Navigating the complexities of international tax laws can be challenging. Consider consulting with a tax professional specializing in authors and international taxation. They can provide tailored advice to optimize your tax strategy and ensure compliance.

By embracing the knowledge and strategies outlined in this guide, you can navigate the complexities of international tax laws and maximize your earnings as a self-published author. Remember to stay informed about tax law changes and seek professional guidance when needed. Stay compliant, optimize your tax obligations, and let your literary endeavors thrive without the burden of excessive taxation.

5 out of 5

| Language | : | English |

| File size | : | 3158 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 64 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Amy J Conway

Amy J Conway Anitha Rathod

Anitha Rathod Andrew Brown

Andrew Brown Jesse Leon

Jesse Leon Anjelah Johnson Reyes

Anjelah Johnson Reyes Angela C Wu

Angela C Wu Charlotte Raby

Charlotte Raby Andrew Cocks

Andrew Cocks Susana Martinez Conde

Susana Martinez Conde Andy Hopper

Andy Hopper Timothy Dalrymple

Timothy Dalrymple Jeff Desjardins

Jeff Desjardins Andrea Pflaumer

Andrea Pflaumer Mordecai Orimiladeye

Mordecai Orimiladeye Paul Carroll

Paul Carroll Ann Haggar

Ann Haggar Andrew Friedman

Andrew Friedman Andrea Thorpe

Andrea Thorpe George Ignatieff

George Ignatieff Pierre 2020

Pierre 2020

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gustavo CoxUnleash Your Child's Financial Brilliance: Introducing the ABCs of Financial...

Gustavo CoxUnleash Your Child's Financial Brilliance: Introducing the ABCs of Financial...

Duane KellyA Step-by-Step Guide to Raising Capable and Grateful Kids in an Over-Entitled...

Duane KellyA Step-by-Step Guide to Raising Capable and Grateful Kids in an Over-Entitled...

Jesse BellPeter Piper's Practical Principles of Plain and Perfect Pronunciation: Unlock...

Jesse BellPeter Piper's Practical Principles of Plain and Perfect Pronunciation: Unlock... Gordon CoxFollow ·4.2k

Gordon CoxFollow ·4.2k Jimmy ButlerFollow ·8.7k

Jimmy ButlerFollow ·8.7k Dan HendersonFollow ·5.5k

Dan HendersonFollow ·5.5k Mario BenedettiFollow ·11.5k

Mario BenedettiFollow ·11.5k Dan BrownFollow ·2.2k

Dan BrownFollow ·2.2k Yukio MishimaFollow ·8.3k

Yukio MishimaFollow ·8.3k Jeremy MitchellFollow ·12.2k

Jeremy MitchellFollow ·12.2k Kelly BlairFollow ·17.2k

Kelly BlairFollow ·17.2k

Bryce Foster

Bryce FosterCelebrate the Luck of the Irish: Unveiling Saint...

As the verdant hues of spring brush...

Chase Simmons

Chase SimmonsCody Rodeo: A Photographic Journey into the Heart of the...

Step into the arena of the...

David Mitchell

David MitchellUnveiling the Enchanting World of Door County Quilts: A...

Step into the Heart of Amish Country in...

Floyd Powell

Floyd PowellCowboy Chatter: Unraveling the Enigmatic Tales of the Old...

Step into the...

Ismael Hayes

Ismael HayesUnlock Content Marketing Mastery: How to Create...

In today's digital landscape, content is...

Boris Pasternak

Boris PasternakMore Than 200 Hardball Questions For The Thinking Fan

The Ultimate Baseball Trivia Challenge Are...

5 out of 5

| Language | : | English |

| File size | : | 3158 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 64 pages |