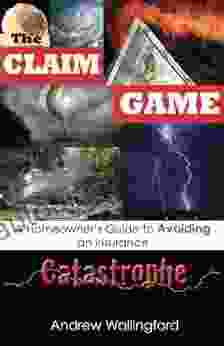

Homeowner's Guide to Avoiding an Insurance Catastrophe: Protect Your Home and Valuables

Owning a home is a significant investment and a source of pride. However, unforeseen events can strike at any moment, potentially jeopardizing your home and the belongings you cherish. Home insurance is essential in mitigating financial losses during such calamities, but navigating the claims process can be daunting. This comprehensive guide will empower you with the knowledge and strategies necessary to avoid insurance catastrophes and ensure the well-being of your home and family.

Home insurance policies provide coverage for various perils, including fire, theft, windstorms, and water damage. The specific coverages and limits vary depending on the policy and your location.

- Dwelling Coverage: Protects the physical structure of your home, including walls, roof, and foundation.

- Personal Property Coverage: Covers your belongings, such as furniture, appliances, and clothing.

- Liability Coverage: Provides protection against legal claims arising from accidents or injuries occurring on your property.

It is crucial to assess your coverage needs thoroughly and select a policy that aligns with your risk profile. Underinsured homes are particularly vulnerable to financial setbacks in the event of a disaster.

4.7 out of 5

| Language | : | English |

| File size | : | 573 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 286 pages |

| Lending | : | Enabled |

Proactive measures can significantly reduce the likelihood of damage to your home and minimize potential insurance claims.

- Regular Maintenance: Perform routine inspections and maintenance on your home's exterior and interior. Address any issues promptly to prevent small problems from escalating into costly repairs.

- Wind Mitigation: Install hurricane shutters or impact-resistant windows to protect your home from wind damage. Reinforce your roof to withstand high winds.

- Water Mitigation: Clean gutters and downspouts to prevent water accumulation. Consider installing a sump pump and battery backup to safeguard against flooding.

- Fire Prevention: Regularly inspect and clean electrical wiring and appliances. Install smoke detectors and fire extinguishers throughout your home.

In the aftermath of a disaster, it can be challenging to recall every item you owned. Thorough documentation will simplify the claims process and ensure you receive fair compensation.

- Inventory List: Create a detailed inventory of your personal belongings, including descriptions, serial numbers, and estimated values.

- Photographs and Video: Take photographs or videos of your home and its contents for further documentation.

- Appraisal: Obtain appraisals for high-value items, such as jewelry or artwork, to establish their worth.

In the event of a disaster, acting promptly and effectively is crucial.

- Contact Your Insurer: Report the damage to your insurance company immediately. Provide clear and concise details of the incident.

- Document the Damage: Take photographs and videos of the damage to support your claim.

- Cooperate with Adjusters: Insurance adjusters will inspect the damage and assess the extent of the loss. Provide them with all necessary documentation.

- Negotiate a Fair Settlement: Review the adjuster's report carefully and negotiate a settlement that fairly compensates you for your losses.

Certain actions or omissions can lead to your insurance claim being denied.

- Late Reporting: Failing to report a claim within the specified time frame can result in a denial.

- Misrepresentation of Facts: Providing false or misleading information about the incident or damage can invalidate your claim.

- Lack of Documentation: Inadequate documentation can make it difficult to prove your losses and justify a settlement.

Homeownership comes with inherent risks, but by implementing the strategies outlined in this guide, you can significantly reduce the likelihood of an insurance catastrophe. By understanding your coverage, mitigating risks, documenting your valuables, and filing claims promptly and effectively, you can safeguard your home and ensure peace of mind for you and your family. Remember, prevention is key, and proactive measures will pay dividends in the event of unforeseen events.

4.7 out of 5

| Language | : | English |

| File size | : | 573 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 286 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia John Wareham

John Wareham Colin Pask

Colin Pask Ethan Long

Ethan Long I Randolph Daniel

I Randolph Daniel Jennifer Jordan

Jennifer Jordan Paul Mason

Paul Mason Andrea B Rugh

Andrea B Rugh Andrea Pelleschi

Andrea Pelleschi Angela Bull

Angela Bull Andrius Jac

Andrius Jac Andrew Mcafee

Andrew Mcafee Andrew Smith

Andrew Smith John Allen

John Allen Angela Grassi

Angela Grassi George Ivanoff

George Ivanoff James D Kirkpatrick

James D Kirkpatrick Katsuo Yamazaki

Katsuo Yamazaki Andrew Moor

Andrew Moor Deborah D Douglas

Deborah D Douglas Angela Ferraro Fanning

Angela Ferraro Fanning

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jett PowellFollow ·13.6k

Jett PowellFollow ·13.6k Truman CapoteFollow ·7.7k

Truman CapoteFollow ·7.7k Winston HayesFollow ·12.6k

Winston HayesFollow ·12.6k Jeffery BellFollow ·10.3k

Jeffery BellFollow ·10.3k Bret MitchellFollow ·3.6k

Bret MitchellFollow ·3.6k Francisco CoxFollow ·19.2k

Francisco CoxFollow ·19.2k George R.R. MartinFollow ·14.4k

George R.R. MartinFollow ·14.4k Javier BellFollow ·2.2k

Javier BellFollow ·2.2k

Bryce Foster

Bryce FosterCelebrate the Luck of the Irish: Unveiling Saint...

As the verdant hues of spring brush...

Chase Simmons

Chase SimmonsCody Rodeo: A Photographic Journey into the Heart of the...

Step into the arena of the...

David Mitchell

David MitchellUnveiling the Enchanting World of Door County Quilts: A...

Step into the Heart of Amish Country in...

Floyd Powell

Floyd PowellCowboy Chatter: Unraveling the Enigmatic Tales of the Old...

Step into the...

Ismael Hayes

Ismael HayesUnlock Content Marketing Mastery: How to Create...

In today's digital landscape, content is...

Boris Pasternak

Boris PasternakMore Than 200 Hardball Questions For The Thinking Fan

The Ultimate Baseball Trivia Challenge Are...

4.7 out of 5

| Language | : | English |

| File size | : | 573 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 286 pages |

| Lending | : | Enabled |