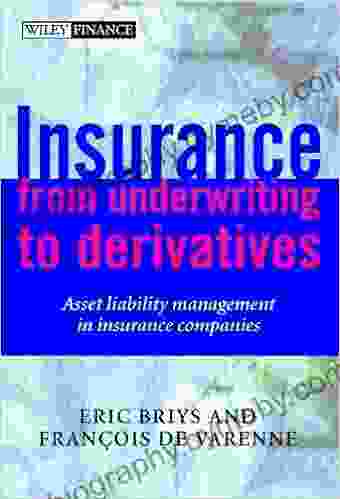

Asset Liability Management in Insurance Companies: Unlocking Financial Stability and Risk Mitigation with Wiley Finance 342

Overview

Asset Liability Management (ALM) plays a pivotal role in the financial stability and long-term success of insurance companies. It involves strategically aligning assets and liabilities to optimize risk and return profiles, ensuring solvency, and meeting regulatory requirements.

4.6 out of 5

| Language | : | English |

| File size | : | 2627 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 176 pages |

| Lending | : | Enabled |

Wiley Finance 342: Asset Liability Management in Insurance Companies is a comprehensive guide that provides a deep understanding of ALM principles and best practices specifically tailored to the insurance industry. This book empowers insurance professionals with the knowledge and tools to effectively manage their portfolios, mitigate risks, and achieve financial objectives.

Key Features

- Comprehensive Coverage: Covers all aspects of ALM in insurance companies, including asset-liability matching, risk management, investment strategies, and regulatory compliance.

- Insurance-Specific Focus: Addresses the unique challenges and considerations faced by insurance companies in managing their assets and liabilities.

- Practical Insights: Provides real-world case studies and examples to illustrate ALM applications and best practices.

- Expert Authorship: Written by a team of experienced insurance and finance professionals, ensuring accuracy and relevance.

- Up-to-date Information: Includes the latest developments and trends in ALM, keeping readers informed of industry best practices.

Benefits of Using Wiley Finance 342

By leveraging the knowledge and guidance provided in Wiley Finance 342, insurance companies can reap numerous benefits, including:

- Improved Financial Stability: Optimizing asset-liability matching reduces risk and ensures solvency, providing a solid foundation for long-term growth.

- Enhanced Risk Management: Effective ALM strategies mitigate risks associated with interest rate fluctuations, inflation, and other economic uncertainties.

- Optimized Investment Strategies: Guidance on asset allocation, diversification, and investment strategies helps insurance companies maximize returns while managing risk.

- Improved Regulatory Compliance: Understanding and implementing ALM best practices ensures compliance with regulatory requirements, reducing the risk of penalties and reputational damage.

- Increased Stakeholder Confidence: Transparent and effective ALM practices instill confidence in investors, policyholders, and other stakeholders, enhancing the company's reputation and credibility.

Who Should Read This Book?

Wiley Finance 342: Asset Liability Management in Insurance Companies is an essential resource for:

- Insurance executives and financial professionals

- Actuaries and risk managers

- Investment portfolio managers

- Insurance regulators and policymakers

- Students and researchers in保険 and finance

Wiley Finance 342: Asset Liability Management in Insurance Companies is an invaluable resource for insurance professionals seeking to enhance their ALM practices and achieve financial stability. Its comprehensive coverage, insurance-specific focus, and practical insights empower readers to navigate the complex and evolving insurance landscape. By embracing the principles and strategies outlined in this book, insurance companies can mitigate risks, optimize their portfolios, and position themselves for long-term success.

Free Download your copy of Wiley Finance 342 today and unlock the key to financial stability and risk mitigation for your insurance company.

4.6 out of 5

| Language | : | English |

| File size | : | 2627 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 176 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Shane White

Shane White Craig S Brantley

Craig S Brantley Amy Guglielmo

Amy Guglielmo Andy Pole

Andy Pole Ann C Hall

Ann C Hall Ana And Jack Hicks

Ana And Jack Hicks Andrew Yule

Andrew Yule Ann Bingham

Ann Bingham Andi Cann

Andi Cann Andrew Ferguson

Andrew Ferguson Michael Allison

Michael Allison Jewel

Jewel Chella Quint

Chella Quint Andrea Warren

Andrea Warren Andrew Patrick Nelson

Andrew Patrick Nelson Angie Thomas

Angie Thomas Andy Ross

Andy Ross Andrew J Wakefield

Andrew J Wakefield Holly Madison

Holly Madison Candy Verney

Candy Verney

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Dallas TurnerUnlock the Secrets of Expat Wealth: The Millionaire Expat Guide to Building...

Dallas TurnerUnlock the Secrets of Expat Wealth: The Millionaire Expat Guide to Building... Ricky BellFollow ·12.6k

Ricky BellFollow ·12.6k Diego BlairFollow ·14.6k

Diego BlairFollow ·14.6k Dakota PowellFollow ·7.2k

Dakota PowellFollow ·7.2k Joseph HellerFollow ·4.3k

Joseph HellerFollow ·4.3k Theodore MitchellFollow ·14k

Theodore MitchellFollow ·14k Andy HayesFollow ·8.3k

Andy HayesFollow ·8.3k Aldous HuxleyFollow ·19.1k

Aldous HuxleyFollow ·19.1k Emilio CoxFollow ·5.4k

Emilio CoxFollow ·5.4k

Bryce Foster

Bryce FosterCelebrate the Luck of the Irish: Unveiling Saint...

As the verdant hues of spring brush...

Chase Simmons

Chase SimmonsCody Rodeo: A Photographic Journey into the Heart of the...

Step into the arena of the...

David Mitchell

David MitchellUnveiling the Enchanting World of Door County Quilts: A...

Step into the Heart of Amish Country in...

Floyd Powell

Floyd PowellCowboy Chatter: Unraveling the Enigmatic Tales of the Old...

Step into the...

Ismael Hayes

Ismael HayesUnlock Content Marketing Mastery: How to Create...

In today's digital landscape, content is...

Boris Pasternak

Boris PasternakMore Than 200 Hardball Questions For The Thinking Fan

The Ultimate Baseball Trivia Challenge Are...

4.6 out of 5

| Language | : | English |

| File size | : | 2627 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 176 pages |

| Lending | : | Enabled |