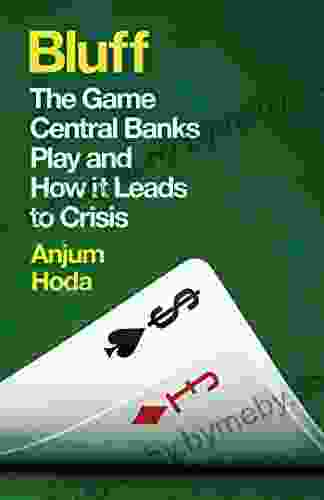

The Game Central Banks Play: A Deep Dive into Monetary Policy and Its Impact

In the realm of economics, central banks stand as enigmatic authorities, wielding immense power to shape the financial landscape. Their decisions, often shrouded in complexity, have the capacity to influence interest rates, control inflation, and guide economic growth. While central banks strive to maintain financial stability, their actions can also sow the seeds of crisis. This article delves into the intricate world of central banks, unveiling the strategies they employ, their impact on markets, and the potential risks that lie ahead.

The Tools of Central Banks

Central banks possess a diverse arsenal of tools to steer the economy. Among the most influential is the ability to set interest rates. By altering the cost of borrowing, central banks can influence businesses' investment decisions and consumer spending habits. Adjusting interest rates can help curb inflation, stimulate economic growth, or stabilize financial markets in times of distress.

4.5 out of 5

| Language | : | English |

| File size | : | 1479 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 234 pages |

| Screen Reader | : | Supported |

Quantitative easing (QE) is another tool central banks employ to inject liquidity into the financial system. Through QE, central banks Free Download government bonds and other assets, increasing the money supply. This measure aims to lower long-term interest rates and encourage lending and investment.

The Impact of Central Bank Policies

Central bank policies have a profound impact on various sectors of the economy. Interest rate changes affect borrowing costs for businesses, homeowners, and governments. Low interest rates can stimulate economic activity, but they can also fuel asset bubbles and financial instability if not managed prudently.

QE can help boost economic growth by increasing the money supply and lowering interest rates. However, excessive QE can lead to inflation, currency devaluation, and potential asset price bubbles.

The Risks of Central Bank Actions

While central banks play a crucial role in maintaining financial stability, their actions are not without potential risks. Excessive interest rate cuts can lead to excessive debt accumulation, asset bubbles, and financial market volatility. Uncontrolled QE can fuel inflation and undermine the value of currencies.

Moreover, central bank independence can sometimes lead to a lack of accountability. Central banks may be hesitant to raise interest rates or unwind QE programs for fear of upsetting financial markets or hindering economic growth, even if such actions are necessary to prevent future crises.

The Road to Crisis

A series of missteps and misguided policies can pave the way for central bank-induced crises. When interest rates are kept artificially low for an extended period, it can encourage excessive risk-taking and leverage in the financial system. This can lead to asset bubbles and a buildup of financial imbalances.

Excessive QE can also contribute to financial instability. By flooding the market with liquidity, QE can drive up asset prices and create bubbles. When these bubbles burst, it can trigger a sharp decline in asset values and a loss of confidence in the financial system.

Case Studies: From Boom to Bust

History is replete with examples of central bank actions that have led to financial crises. The 2008 global financial crisis, sparked by the collapse of the US housing market, was partly attributed to years of low interest rates and excessive lending by banks.

The Japanese asset price bubble of the 1980s and 1990s was another case where central bank policies contributed to a financial crisis. The Bank of Japan's loose monetary policy fueled a surge in asset prices, which eventually collapsed, leading to a prolonged period of economic stagnation.

Central banks are powerful institutions that play a critical role in shaping economic outcomes. While their actions can stimulate growth and maintain financial stability, they can also lead to unintended consequences and even crises. Understanding the complexities of central banking is essential for policymakers, investors, and anyone interested in the health of the global economy.

By unraveling the game central banks play, we gain valuable insights into the delicate balance between economic growth, financial stability, and the risks that lie ahead. As we navigate an increasingly interconnected financial landscape, it is imperative to exercise caution and foresight to prevent the mistakes of the past from repeating themselves.

4.5 out of 5

| Language | : | English |

| File size | : | 1479 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 234 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Andrew Weitzen

Andrew Weitzen Amy Lyndon

Amy Lyndon Kelly Terwilliger

Kelly Terwilliger Andrea Sfiligoi

Andrea Sfiligoi Jaycee Wolfe

Jaycee Wolfe Suzy Amis Cameron

Suzy Amis Cameron Violet Moller

Violet Moller Amy Lang Ma

Amy Lang Ma Angie Fox

Angie Fox Ana Victoria Calderon

Ana Victoria Calderon John L Parker Jr

John L Parker Jr Rick Brandon

Rick Brandon Dawn G Marsh

Dawn G Marsh Vassos Alexander

Vassos Alexander Michelle Caffrey

Michelle Caffrey Andrew Lang

Andrew Lang Andy Tyson

Andy Tyson R K Wheeler

R K Wheeler Christine Conners

Christine Conners Andy Mcilree

Andy Mcilree

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Don ColemanFollow ·12.5k

Don ColemanFollow ·12.5k Dustin RichardsonFollow ·6.5k

Dustin RichardsonFollow ·6.5k George R.R. MartinFollow ·14.4k

George R.R. MartinFollow ·14.4k Nikolai GogolFollow ·2.7k

Nikolai GogolFollow ·2.7k Ed CooperFollow ·14.4k

Ed CooperFollow ·14.4k Herbert CoxFollow ·6.3k

Herbert CoxFollow ·6.3k Anthony BurgessFollow ·7k

Anthony BurgessFollow ·7k Ken FollettFollow ·10.7k

Ken FollettFollow ·10.7k

Bryce Foster

Bryce FosterCelebrate the Luck of the Irish: Unveiling Saint...

As the verdant hues of spring brush...

Chase Simmons

Chase SimmonsCody Rodeo: A Photographic Journey into the Heart of the...

Step into the arena of the...

David Mitchell

David MitchellUnveiling the Enchanting World of Door County Quilts: A...

Step into the Heart of Amish Country in...

Floyd Powell

Floyd PowellCowboy Chatter: Unraveling the Enigmatic Tales of the Old...

Step into the...

Ismael Hayes

Ismael HayesUnlock Content Marketing Mastery: How to Create...

In today's digital landscape, content is...

Boris Pasternak

Boris PasternakMore Than 200 Hardball Questions For The Thinking Fan

The Ultimate Baseball Trivia Challenge Are...

4.5 out of 5

| Language | : | English |

| File size | : | 1479 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 234 pages |

| Screen Reader | : | Supported |