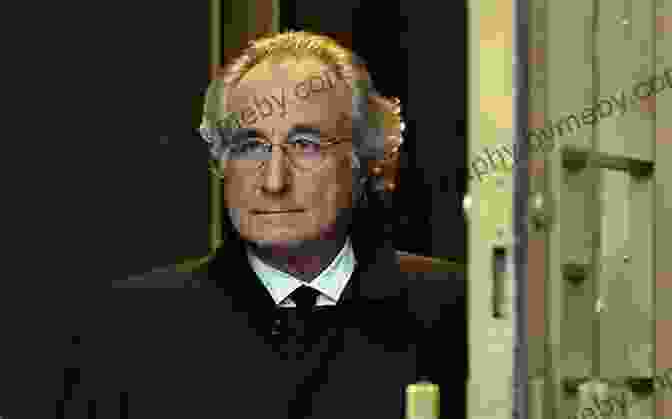

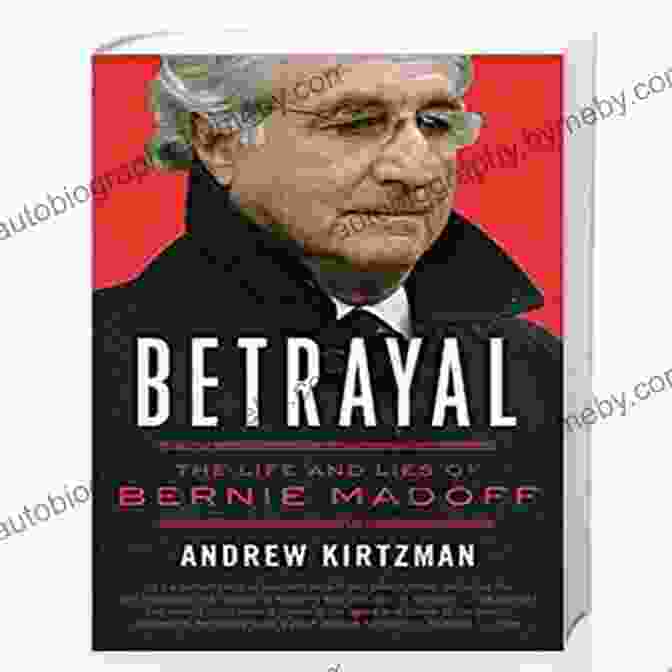

Betrayal: Unveiling the Life and Lies of Bernie Madoff, the Notorious Con Man

The annals of financial history are marked by a litany of infamous scams and swindles, but none has captured the public's imagination quite like the colossal Ponzi scheme orchestrated by Bernard Lawrence "Bernie" Madoff. For decades, Madoff's name was synonymous with wealth and financial acumen, but beneath the veneer of respectability lurked a web of deceit and betrayal that would ultimately shatter the lives of countless individuals.

4.5 out of 5

| Language | : | English |

| File size | : | 719 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

The Rise and Fall of a Financial Titan

Born into a modest family in Queens, New York, Madoff exhibited a keen interest in the financial world from an early age. After graduating from Hofstra University with a degree in political science, he founded Bernard L. Madoff Investment Securities in 1960. Initially, the firm specialized in penny stocks, but Madoff quickly transitioned into the realm of asset management, promising clients returns that consistently outperformed the market.

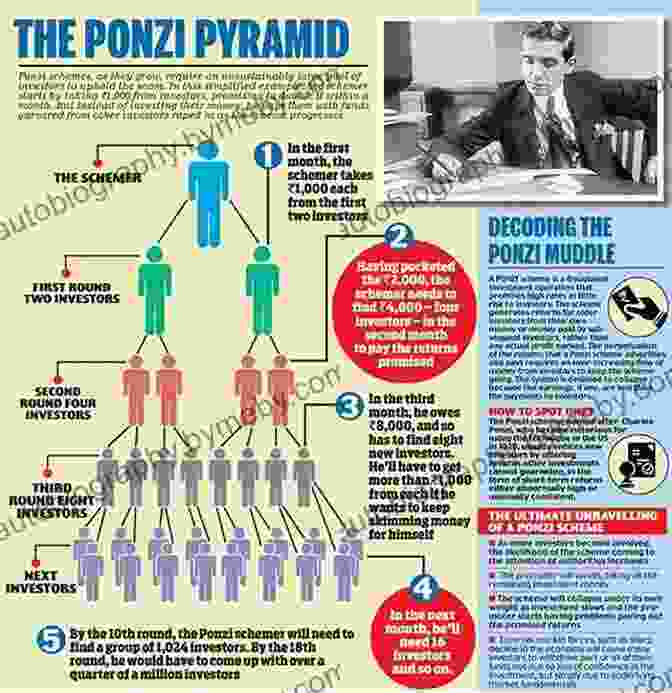

As Madoff's reputation grew, so did the influx of investors eager to capitalize on his seemingly magical touch. Wealthy individuals, hedge funds, and charitable organizations alike entrusted their fortunes to Madoff, believing that their investments were in safe hands. However, unknown to these clients, the returns they were receiving were not the result of prudent investing but rather a carefully constructed pyramid scheme.

The Ponzi Scheme: A House of Cards

At its core, Madoff's Ponzi scheme was a classic case of robbing Peter to pay Paul. Early investors were paid their returns using money from new clients. As the scheme grew, Madoff needed to bring in ever-increasing sums of money to maintain the illusion of profitability. To lure new investors, he leveraged his connections and reputation, creating an aura of exclusivity around his firm.

Madoff's operation was meticulously planned and executed, with a team of trusted associates and family members handling various aspects of the deception. They created false account statements, forged documents, and used complex financial jargon to obfuscate the truth. For years, Madoff managed to evade detection by auditors and regulators, who were fooled by his polished exterior and the sheer magnitude of the scheme.

The Unraveling: The Financial Crisis and Beyond

The global financial crisis of 2008 proved to be the catalyst that would ultimately expose Madoff's fraud. As investors sought to redeem their investments amidst the market turmoil, Madoff's Ponzi scheme began to crumble. In December 2008, he confessed his crimes to his sons, who promptly turned him over to authorities.

The arrest of Bernie Madoff sent shockwaves through the financial world and beyond. His victims included individuals from all walks of life, from wealthy celebrities to ordinary retirees who had lost their life savings. The scheme had defrauded investors of an estimated $65 billion, making it the largest financial fraud in history.

The Trial and Conviction

Madoff pleaded guilty to 11 federal felonies, including securities fraud, money laundering, and perjury. He was sentenced to 150 years in prison, a sentence that many felt was too lenient given the magnitude of his crimes.

In prison, Madoff expressed remorse for his actions but claimed that he had been driven by a desire to help others. Many victims, however, found his apologies hollow and insufficient.

The Legacy of Bernie Madoff

The Bernie Madoff scandal remains a cautionary tale about the dangers of greed and the importance of due diligence when investing. It also exposed the flaws in the regulatory system that allowed such a massive fraud to go undetected for so long.

In the wake of Madoff's crimes, regulators have implemented stricter measures to prevent future Ponzi schemes. Investors have also become more vigilant, demanding greater transparency and accountability from financial institutions. The Madoff scandal has left an indelible mark on the financial landscape, serving as a constant reminder that even the most cunning of fraudsters can be brought to justice.

The story of Bernie Madoff is a complex and tragic tale of deception, betrayal, and the devastating consequences of greed. His Ponzi scheme shattered the lives of countless individuals and eroded trust in the financial system. While Madoff's legacy may forever be tainted by his crimes, his downfall has also led to important reforms and a greater awareness of the risks involved in investing. The lessons learned from the Madoff scandal will continue to shape the financial world for years to come.

4.5 out of 5

| Language | : | English |

| File size | : | 719 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Kelly Terwilliger

Kelly Terwilliger John Allen

John Allen Sebastien De Castell

Sebastien De Castell Shirley Ballas

Shirley Ballas Elijah N Daniel

Elijah N Daniel Chris Smaje

Chris Smaje David Tracey

David Tracey Andrea Chesman

Andrea Chesman Steve Justice

Steve Justice Stephen Mertz

Stephen Mertz Joyce Tyldesley

Joyce Tyldesley Andrew Wallingford

Andrew Wallingford Anette Henningson

Anette Henningson Chris Elle Dove

Chris Elle Dove Rangarajan K Sundaram

Rangarajan K Sundaram Andrew Hudgins

Andrew Hudgins Jenell Diegor

Jenell Diegor Edd S Noell

Edd S Noell Damian Hall

Damian Hall Andrea Blake

Andrea Blake

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Chase SimmonsWitness the Cinematic Mastery of David Lean: A Journey Through His Life and...

Chase SimmonsWitness the Cinematic Mastery of David Lean: A Journey Through His Life and...

Morris CarterUnveiling the Enigma of Hatchepsut: A Journey into the Life of Egypt's Female...

Morris CarterUnveiling the Enigma of Hatchepsut: A Journey into the Life of Egypt's Female... Chadwick PowellFollow ·19.9k

Chadwick PowellFollow ·19.9k Norman ButlerFollow ·3.5k

Norman ButlerFollow ·3.5k Shawn ReedFollow ·19.8k

Shawn ReedFollow ·19.8k Jorge AmadoFollow ·14k

Jorge AmadoFollow ·14k Bernard PowellFollow ·17k

Bernard PowellFollow ·17k Elton HayesFollow ·10.6k

Elton HayesFollow ·10.6k Sean TurnerFollow ·7k

Sean TurnerFollow ·7k Felix HayesFollow ·12.7k

Felix HayesFollow ·12.7k

Bryce Foster

Bryce FosterCelebrate the Luck of the Irish: Unveiling Saint...

As the verdant hues of spring brush...

Chase Simmons

Chase SimmonsCody Rodeo: A Photographic Journey into the Heart of the...

Step into the arena of the...

David Mitchell

David MitchellUnveiling the Enchanting World of Door County Quilts: A...

Step into the Heart of Amish Country in...

Floyd Powell

Floyd PowellCowboy Chatter: Unraveling the Enigmatic Tales of the Old...

Step into the...

Ismael Hayes

Ismael HayesUnlock Content Marketing Mastery: How to Create...

In today's digital landscape, content is...

Boris Pasternak

Boris PasternakMore Than 200 Hardball Questions For The Thinking Fan

The Ultimate Baseball Trivia Challenge Are...

4.5 out of 5

| Language | : | English |

| File size | : | 719 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |